40+ Illinois Tax Calculator 2022

Web The Kicker credit amount is 4428 of 2022 state taxes owed before applying any credits. Individual Income Tax Return.

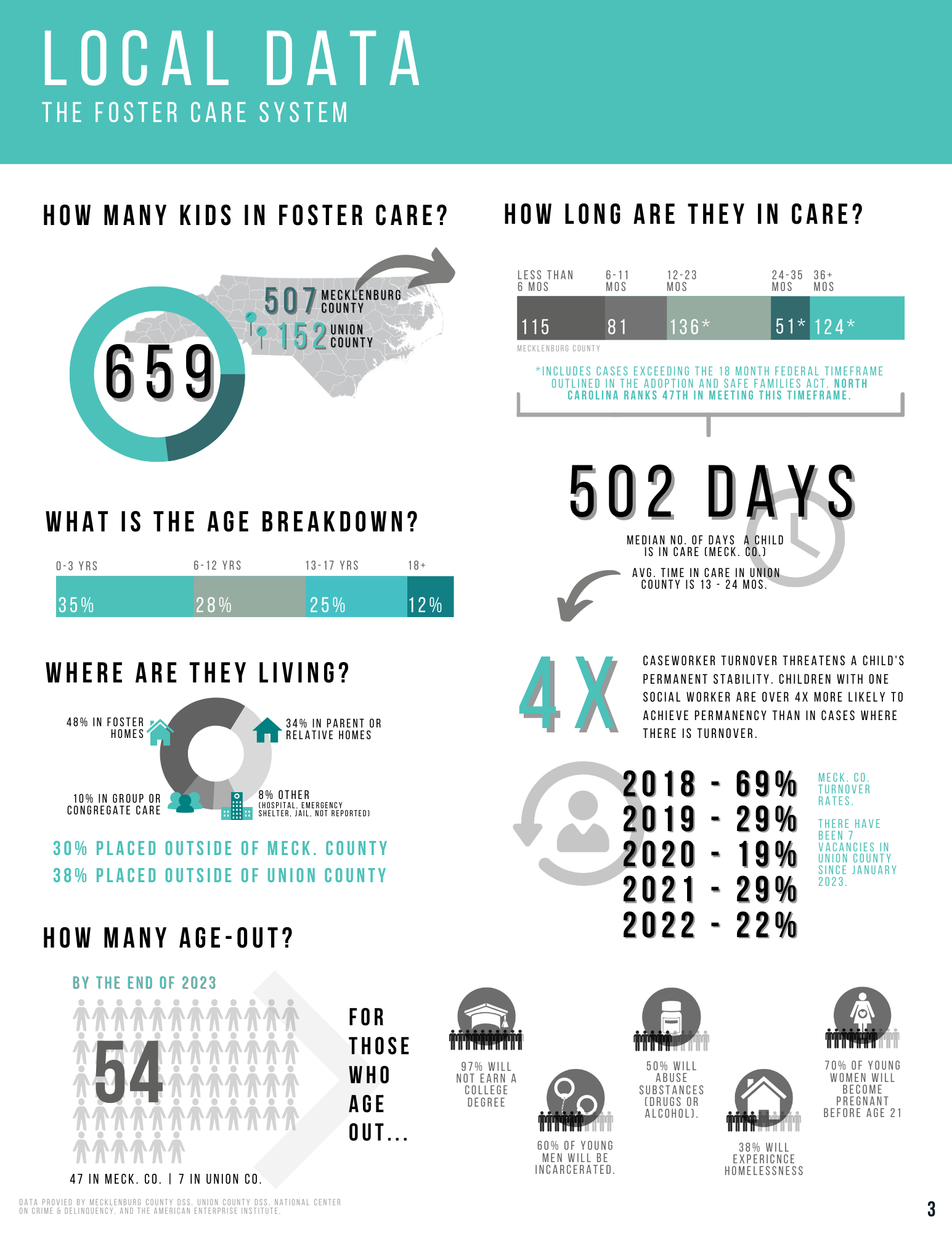

Data Congregations For Kids

Web Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

. Web Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The state does not offer a standard deduction but allows you to use. Complete Edit or Print Tax Forms Instantly.

The Illinois income tax rate is 495 percent 0495. Web Instructions Illinois state income tax rate for current tax year. Web SmartAssets Illinois paycheck calculator shows your hourly and salary income after federal state and local taxes.

4b Enter the total amount of pass-through withholding made on your behalf. Complete Edit or Print Tax Forms Instantly. Just enter the wages tax withholdings and other information.

495 The Illinois Tax Estimator Select a Tax Year 2021 2022 2023 2024 Select Your Filing Status Single. Web The due date for filing your 2022 Form IL-1040 and paying any tax you owe is April 18 2023. Access IRS Tax Forms.

2023 and data from the Tax. Web Heres a breakdown of these amounts for tax year 2022 which is filed in 2023. Discover Helpful Information And Resources On Taxes From AARP.

Web 2022 Illinois Tax Tables with 2024 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. 200000 for single filers heads of household and qualifying widowers with dependent children. Illinois has a flat income tax rate of 495 percent.

Annual income Tax year. Updated on Sep 19 2023. Free tool to calculate your hourly and salary income after federal state.

Web This is the Illinois portion of your federal total income. Illinois offers a flat rate on individual income tax which is 495. The Federal or IRS Taxes Are Listed.

This means that those with higher state tax liability are likely to receive a. Ad Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Web The Illinois Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year.

Illinois does not tax either retirement and Social Security income as. Web Illinois tax calculator. Continue with Step 3 on Page 2.

Web Illinois Salary Tax Calculator for the Tax Year 202324. Electronic only one copy. Web What is the Illinois income tax rate in 2023.

Web 4a Enter the total amount of this years Illinois withholding from your W-2 and 1099 forms. Web For tax years 2022 filed by April 2023 and before the Illinois EITC is 18 of whatever you got from the federal program. Web The big picture.

Web Illinois Paycheck Calculator Easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget Last. You are able to use our Illinois State Tax Calculator to calculate your total tax costs in the tax year 202324. Calculations are estimates based on tax rates as of Jan.

208 percent of a homes assessed value average Real. Compare your take home after tax and. Web The total taxes deducted for a single filer are 116154 monthly or 5361 bi-weekly.

Ad Access Tax Forms. For tax years 2023 filed in 2024 and. Web Illinois Department of Revenue.

Web You must make estimated income tax payments if you reasonably expect your tax liability for the year to exceed 1000 after subtracting your Illinois withholding pass-through. Enter your info to see your take home pay. IL1040 Schedule NR Front R-1222 Printed by authority of the state of.

The personal income tax rate in the state of Illinois is 495. Web Gross income 70000 Total income tax -11581 After-Tax Income 58419 Disclaimer. IL-1040 Front R-1222 Printed by authority of the state.

Income Tax Rate 2022. Web Illinois Income Tax Calculator Estimate your Illinois income tax burden Updated for 2023 tax year on Jul 18 2023 What was updated.

Finder Money Newsletter Money News Smarter Youse

Enterprise It Management Software Ninjaone

Iphone Archives Technotes Blog

Energy Efficiency Incentives For Utilities A Review Of Approaches So Far Ppt

What Is A Fair Tax For Illinois Seiu Local 73

Is An Octagon Regular Or Irregular Quora

Illinois Tax Calculator

Illinois Tax Calculator

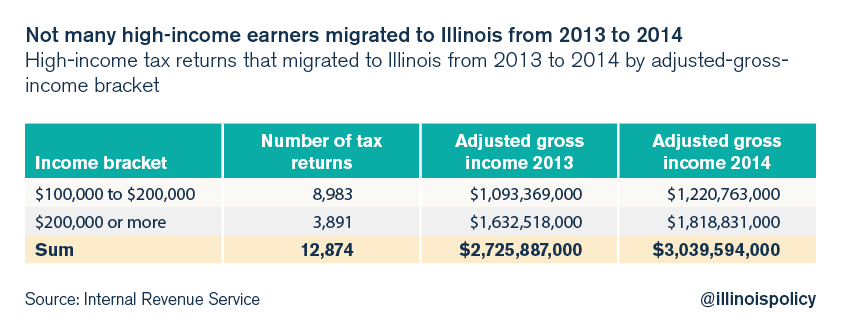

Illinois State Income Taxes Who Really Pays

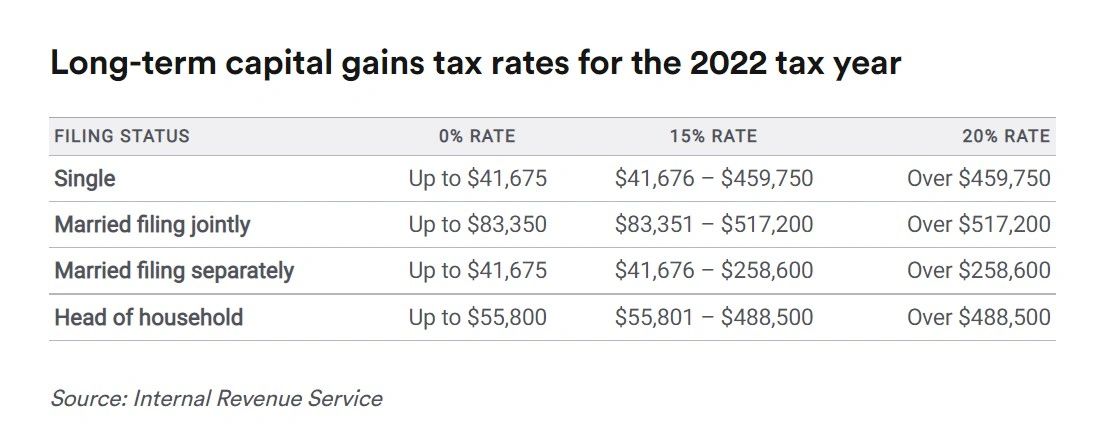

Capital Gains Tax Calculator

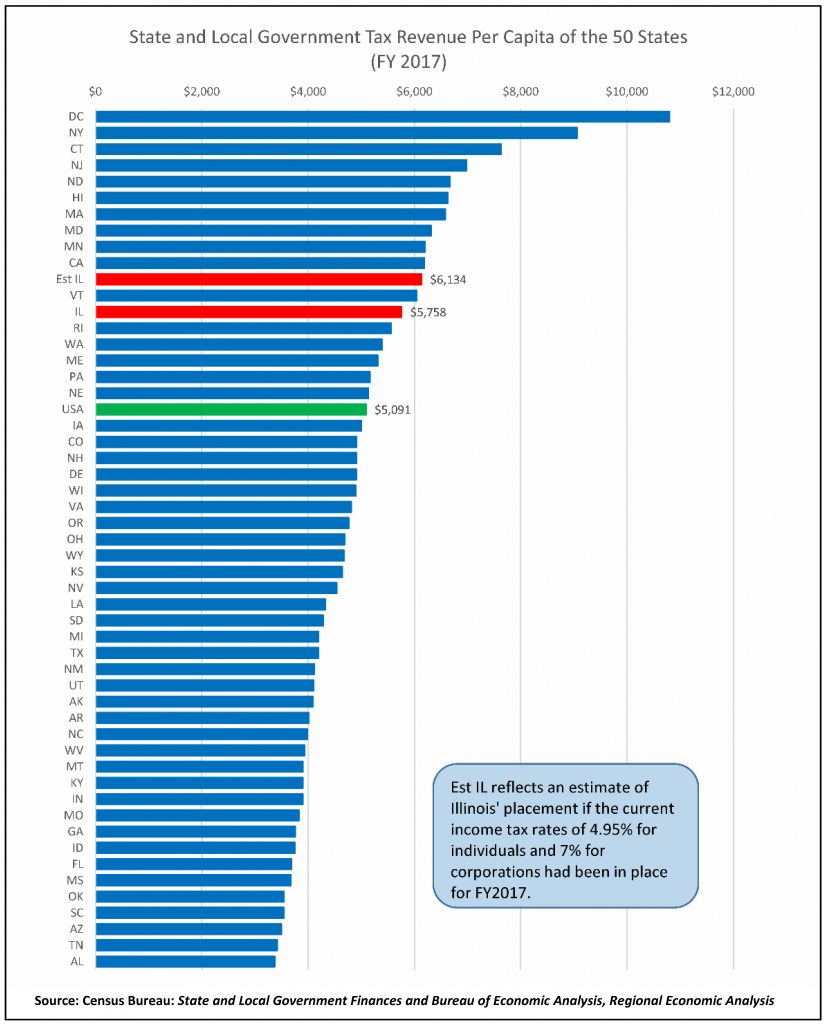

Taxpayers Federation Of Illinois Tax Facts An Illinois Chartbook Overall State And Local Taxes Maurice Scholten

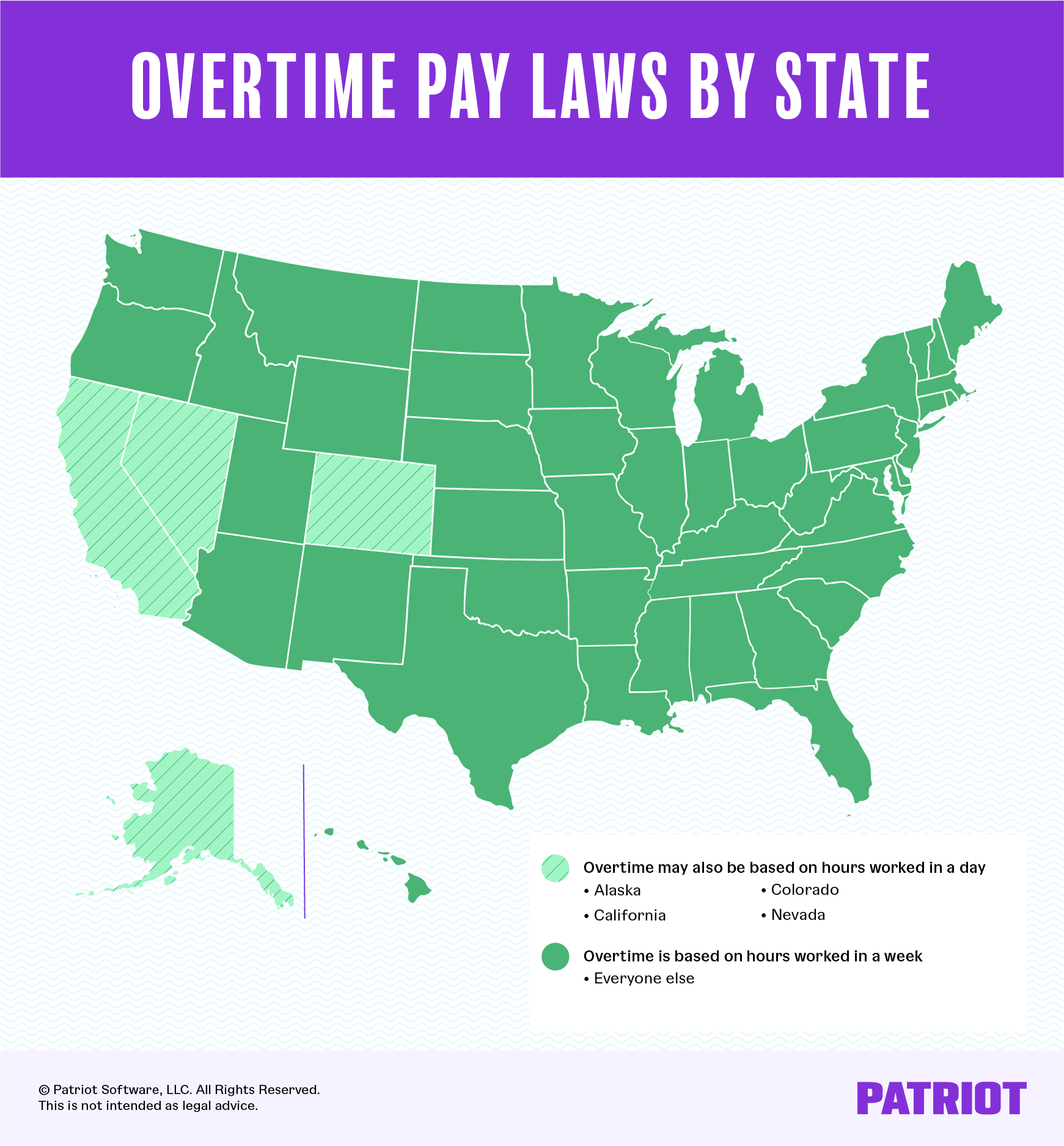

Arizona Wage Law Overtime Lawyer Lore Law Firm

How Much Savings Should I Have Accumulated By Age

Tesla Model 3 Car Insurance Cost Forbes Advisor

Overtime Laws By State Overview Map Beyond

9 Steps To Adjust Your Tax Withholdings For A Larger Paycheck Finder

How To Calculate Illinois Income Tax Withholdings